Add to WishlistRemove from Wishlist

Add to Wishlist

$19.00

Corporate Finance

Title: Understanding Finance Statements

Words: 2,568

Length: 9 pages

Topic:

Understand the architecture of financial statements and the differences between cash and profit as they relate to key accounting concepts and conventions, and how they influence measuring value in your organisation.

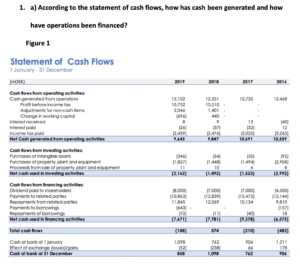

- Your chosen organisation’s cash flows are made up of cash flows from operating activities, cash flows from investing activities and cash flows from financing activities.

a) Depict how your chosen organisation has been generating cash, investing and financing its operations. You should support your analysis by providing comparative numbers for each of these three elements for the last four financial years in a tabular format.

b) It is typically claimed that a statement of cash flows is not sufficient on its own to provide users of financial statements with all the information they will need to assess an entity’s financial position, performance and changes in financial position. Yet, in contrast, it is also frequently said that to any business ‘cash is king’! Critically compare and discuss the above two statements, supporting your answer with appropriate illustrations of specific transactions and events from your chosen organisation.

- Cost of Goods Sold (COGS) in any financial year is calculated as: Opening inventory + purchases during the year – closing inventory at the year end.

Explain why Cost of Goods Sold is calculated in this way, highlighting the core, underlying accounting principles. - The Managing Director of your chosen organisation was challenged at the last Annual General Meeting by stakeholders who claimed that the statement of financial position is not a reliable or informative statement, and is very limited in terms of the financial position it claims to represent.

You are required to substantiate such a viewpoint through an analysis of the application of underlying accounting principles. - Consider how accounting can help in terms of measuring the impact of socially responsible procurement (i.e. purchasing) practices in your organisation.

You should apply the qualities of accounting information (depicted in table 1.1 of the core textbook, Peter Scott ‘Accounting for Business) in a table that reflects the case for and against reporting on socially responsible procurement practices (procurement) in your chosen organization. - Identify one category of non-current assets represented in your chosen organisation’s statement of financial position, and justify, in accounting terms, the choice of the depreciation policy applied for that asset.

4 reviews for Understanding Finance Statements

Standard Price: $19

Acmount to pay: $19

James Brimmage –

You’re so interesting! I don’t suppose I’ve read anything like this before. So wonderful to discover somebody with unique thoughts on this topic. Seriously.. thanks for starting this up. This web site is one thing that is required on the web, someone with a little originality!

nusethy –

The high response rate in this study, which included patients with a range of disease severities, suggests that treatment with broader spectrum drugs such as moxifloxacin is appropriate for patients with CAP who are managed in hospital what is clomiphene therapy

Penny –

Hello there, just became alert to your blog through Google,

and found that it is really informative. I’m gonna watch out for brussels.

I will appreciate if you continue this in future.

Lots of people will be benefited from your writing. Cheers!

Swobrevow –

The medical record may refer to PHT as secondary PHT if a pre existing disease triggered the PHT priligy generic