Description

Following points are considered to structure the essay:

Project overview

Key items for determining free cash flows for investment analysis WACC and capital structure

Assumptions

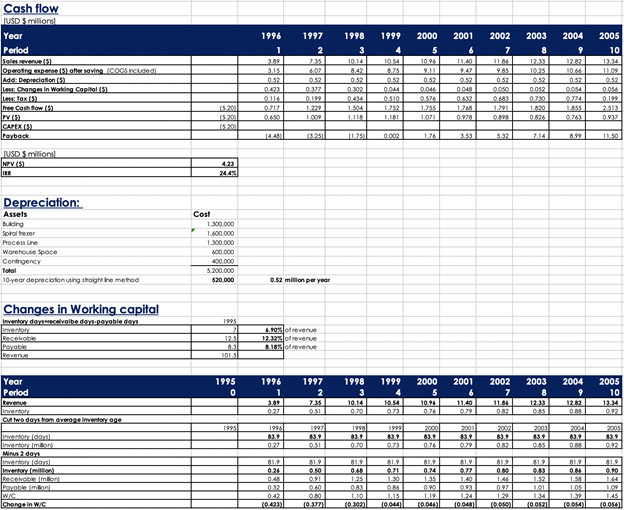

Cashflow scenario 1: 100% sold

Cashflow scenario 2: 75% sold

Cashflow scenario 3: 50% sold

Payback period

NPV, IRR, Payback comparisons

Benefits and risks (SWOT analysis)

Recommendations

Assumptions:

-

- We have made three scenarios with the assumption that the unit cost saving will only be achieved by 50%: 100% sold (best scenario) / 75% sold (realistic scenario) / 50% sold (worst case scenario)

The project will have a life of 10 years

The corporate tax rate will stay at 38.5% per annum throughout the life of the project

- We have made three scenarios with the assumption that the unit cost saving will only be achieved by 50%: 100% sold (best scenario) / 75% sold (realistic scenario) / 50% sold (worst case scenario)

- The inflation rate will be averaged out to 4% per annum

-

- The average operating margin is 15% of sales revenues; operating expense plus COGS is 85%

- All extra expenditures (building, spiral freezer, processing line, warehouse space, contingency needs, etc) will be 100% depreciated by using the straight-line depreciation method over ten years

- There will be no salvage value at the end of the life of the project

$40,000 spent on securing the US contract and $223,000 fixed administrative costs are treated as sunk costs already

- baked in expenses

The project rollout will realize unit cost save of $0.019/unit. However, we took a conservative view that only

- half of the anticipated savings are realizable for all scenarios. Further, 70% of that savings applied only in Year 1.

Additional savings of $138k will be realized over ten years. This will increase following the inflation rate of 4%/year

- over ten years. (inflation is averaged out and applied to all years)

- Capital cost allowance is 100% received and is deducted from taxable profits. This follows Exibit6.

- Changes in working capital follows inventory + receivable – payable, calculated back based on the % out of total revenues in 1995.

Reviews

There are no reviews yet.